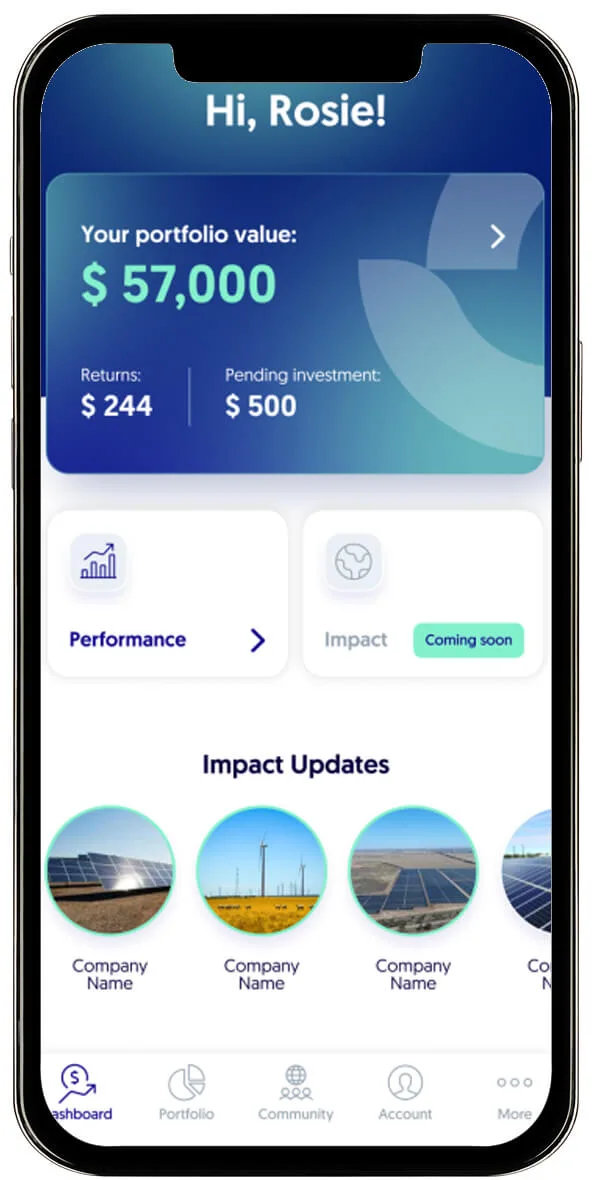

Bloom Impact Investing app review

- Investment product

- Shares, ETFs

- Minimum Investment

- $500

- Number of Portfolios

- 1

- Fees

- $4.50/Month

Summary

Align your money with your values through an easy-to-use app.

Bloom Impact is a useful app that lets you invest in various green assets, including listed businesses, green infrastructure and everything in between.

Focusing on the E in ESG (environmental, social, governance), this app will allow you to directly impact climate solutions.

What does Bloom invest in?

Bloom is an impact investing micro investing fund, which allows you to invest in direct climate action solutions.

You invest in one fund but, if you sign up with Bloom, you'll own a range of green-label exchange-traded funds (ETFs), individual companies, green bonds and green fixed income products.

These include:

- 53 international listed companies

- 5 green ETFs:

- iShares Global Clean Energy ETF

- BetaShares Climate Change Innovation ETF

- VanEck Global Clean Energy ETF

- KraneShares Global Carbon Strategy ETF

- BetaShares Sustainability Leaders Diversified Bond ETF – Currency Hedged

- 24 Australian listed companies

- 1 infrastructure impact fund with solar energy, storage and green building projects

- 9 green and sustainable bonds

- 3 fixed income and alternatives

Who does this app suit?

Bloom is first and foremost an investing app, meaning anyone that believes in the long-term thematic could benefit from this app. Depending on who you ask, the cost of transitioning to net-zero will be between US$125 trillion and US$275 trillion, with investments needing to triple over the next 5 years. This is creating a massive opportunity for anyone who is in the sector.

Going beyond pure financial reasons, Bloom will also appeal to those who want to invest ethically. The app prides itself on giving investors access to green investment options, so you can financially benefit while helping the planet.

The app is also designed for those who are looking to take control of their own money through self managed super funds (SMSFs). One of the features the app offers allows SMSF holders to put a portion of their retirement savings into Bloom.

Key features

Climate impact

One of the key differentiators for Bloom when comparing it to competitors is exclusively investing for climate action. While most funds and apps these days will offer a green option, none of them are exclusively offering environmentally friendly options.

Instant diversification

While investing ethically might make you think you aren't diversified, this isn't true. Despite only focusing on companies that are green, in 1 trade you'll own more than 70 impact investments in 4 different asset classes.

Excludes greenwashing

One of the major drawbacks for ESG investors is greenwashing. Businesses often over-exaggerate the good they are doing, with greenwashing being little more than PR spin to make a company sound as though it is doing the right thing. According to Bloom, you can avoid greenwashing through the app.

Low starting balances

In a nod to retail investors, Bloom has some of the lower minimums on the market.

If you're an individual investor you can start from just $100.

However, if you are signing up to Bloom Impact as part of a trust you will still need a minimum $5,000.

Fees and charges

Bloom's fees are fairly straightforward.

For accounts balances that are $10,000 or less you'll pay:

0.80% p.a. management fees (of the net trust value of the Fund)

$4.50/ per month (account fees)

But for accounts with balances above $10,000:

0.80% p.a. management fees (of the net trust value of the Fund)

No monthly account fees

In terms of green funds, you'll be paying around the industry average with ETFs such as Australian Ethical's high conviction fund having a 0.80% management fee, while the iShares Global Clean Energy ETF (which you would own) charges investors 0.42%.

If you choose its micro investing features, it is a little bit higher than its competition, with Raiz, Spaceship and Pearler all charging monthly fees of less than $3.50.

All 3 have green options, but in terms of a pure play ESG investment, none of them tick this box.

Bloom Impact App Review

Customer reviews of Bloom Impact

| Apple App Store app reviews | 4.8/5 stars based on over 18 reviews |

Support

Bloom offers customer support in 4 main ways:

- Phone

- Live chat which can be found on Bloom's website

- Online contact form

How to sign up

- You'll need to add your basic contact information to be verified, including both your email and phone number. So have your phone handy.

- Choose your account type: Individual or SMSF are available.

- Decide how much you want to invest. Initial investment is a minimum of $100.

- Chose to start up an auto-invest feature, available from $20.

- Add in your banking information

- You're now signed up.

Compare robo-advisors

Your reviews

Cameron Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.