![When will George RR Martin’s The Winds of Winter come out? [Updated]](https://www.findershopping.com.au/finder-au/wp-uploads/2022/04/TheWindsofWinter_GettyImages_450x250.jpg)

When will George RR Martin’s The Winds of Winter come out? [Updated]

The Winds of Winter is one of the most anticipated novels of all time, so when might it finally release?

Read more…![When will George RR Martin’s The Winds of Winter come out? [Updated]](https://www.findershopping.com.au/finder-au/wp-uploads/2022/04/TheWindsofWinter_GettyImages_450x250.jpg)

The Winds of Winter is one of the most anticipated novels of all time, so when might it finally release?

Read more…

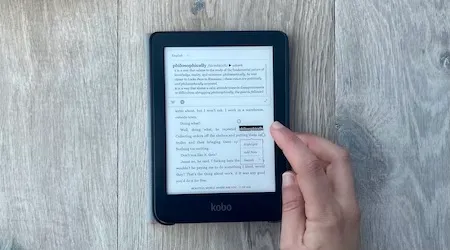

If you've been looking for a handbag-sized ebook reader, this is the one to get.

Read more…

Amazon's Kindle stands atop the ereader mountaintop, so find out the best storefronts to purchase it from.

Read more…

Shadows Reel is the staggering 22nd entry in the Joe Pickett series. In the book, a local murder gets tangled up in the reappearance of Nazi memorabilia.

Read more…

Score up to 52% off It Starts With Us, the hotly anticipated sequel to It End With Us by Colleen Hoover.

Read more…

The Kobo Elipsa makes a valiant attempt to bridge the gap between ereader and enote. It doesn’t manage to excel at being one or the other as its big for an ereader and slow for an enote.

Read more…

The biggest name in audiobooks is Audible by Amazon, but is it worth the cost for Australians? Is it better than Kobo, Scribd and Blinkist?

Read more…

If you're looking for a new ebook reader or want to know more about ebooks, we've got you covered.

Read more…Up to 80% off: Today's Deals

QBD Books sale: Up to 60% off

33% off on a 12-month plan

25% off on 24-month plan

14% discount on a 6-month plan

35% off a 3-month plan

Up to 40% off top-selling books at Google Play

10% off sitewide

Up to 81% off magazine subscription

Up to 50% off: Black Friday Sale

Up to 50% off selected books

Up to 30% off used books

Up to 70% off over 700 Kindle titles

Up to 49% off best-sellers

Over 30% off everything: Outlet Store

eBay Plus subscription for only $4.99 a month

36% off 5 Ingredients Mediterranean

Up to 20% off QBD best sellers

FREE shipping on all orders over $35 + FREE returns

$20 & under: Hottest Deals

Read and listen for FREE with a 30-day Kobo Plus trial

Up to 50% off cookbooks

FREE shipping on orders over $89

Up to 70% off books

Up to 30% off newest ebooks at Google Play

FREE pick-up

FREE express metro delivery

Up to 88% off book sale

FREE shipping on any eReaders and accessories

Subscribe for $13.99/month + FREE for 30 days

15% off range Circle calendars and planners

Subscription boxes from $28

FREE shipping on Kobo ereaders

10% off your first order

FREE worldwide delivery on all orders

Next day free shipping on $150+ order

Subscribe and get 10% off your first order

Rewards, Join Now and Receive An Instant 500 Points

Gift Subscriptions Now: $40 or Less

Bestseller Mag Subscriptions Under $30

Icons made by Freepik from www.flaticon.com

The biggest name in audiobooks is Audible by Amazon, but is it worth the cost for Australians? Is it better than Kobo, Scribd and Blinkist?

Looking for a new read? Why not shop online and browse hundreds of titles at once?

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

findershopping.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.