Important information

On April 2023, BDCU Alliance Bank has merged with Bendigo Bank.

Existing BDCU Alliance Bank customers will be notified directly about changes to their banking.

BDCU Alliance Bank is a customer-owned bank based in regional NSW. Headquartered in Bowral, it is part of the Alliance Bank Group with Bendigo and Adelaide Bank, and offers a wide range of transaction accounts, savings accounts and other financial products to its customers.

On April 2023, BDCU Alliance Bank has merged with Bendigo Bank.

Existing BDCU Alliance Bank customers will be notified directly about changes to their banking.

BDCU Alliance Bank is part of the Alliance Bank Group. The Group is an alliance of four independent mutual entities (BDCU Limited, AWA Mutual Limited, Service One Mutual Limited and Circle Mutual Limited) with Bendigo and Adelaide Bank. This enables BDCU to offer banking products on behalf of Bendigo and Adelaide Bank, while also keeping its own branding and maintaining its local presence throughout the Southern Highlands region of NSW.

If you’re looking for a bank account to suit your financial needs, BDCU offers a variety of transaction accounts, savings accounts and term deposits. These accounts combine flexible features with competitive interest rates, as well as personalised customer service for every member.

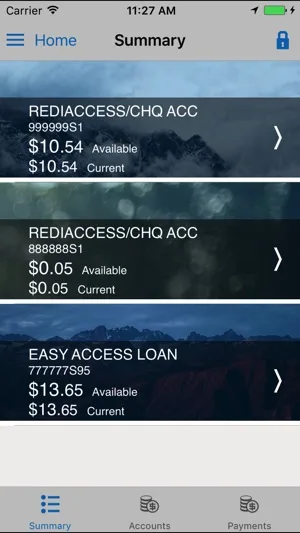

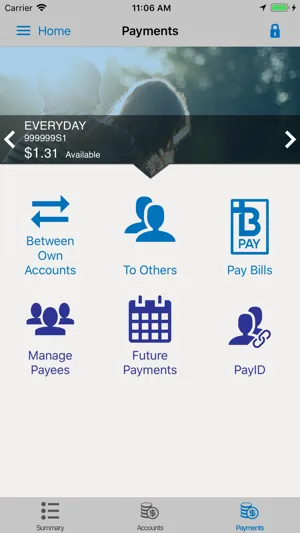

BDCU’S Internet Banking portal allows members to access their accounts, check transaction details and statements, pay bills and transfer funds to other accounts. The bank also uses sophisticated firewalls and 128-bit SSL encryption to ensure the security of your funds.

There are three ways to register for BDCU Alliance Bank Internet Banking:

Notable features include:

| Login Page | Account Balance | Payments |

|---|---|---|

|  |  |

Designed for customers who receive an Australian Government pension, this account features funds available at call and no minimum monthly or opening balance requirements. Access is by card, Internet and phone banking, while an optional cheque book is also available.

If the total value of loans and deposits you hold with BDCU exceeds $2,000, this account doesn’t charge any transaction fees. Other features include no opening or monthly balance requirements, card access and an optional cheque book.

This transaction account can be linked to your BDCU home loan and provide a 100% offset benefit. There are no monthly fees, no fees for eligible transactions and no minimum balance requirement.

Designed to help members over the age of 55 enjoy their retirement, this account offers hassle-free everyday banking. Your funds are available at call and there is no minimum opening balance.

This online savings account allows you to provide support to a nominated community organisation. It has no opening or monthly balance requirements, no monthly fees, and your funds are available at call.

This account pays bonus interest every month you deposit at least $10 and make no withdrawals. There is no minimum monthly balance requirement and no monthly transaction fee, and interest is calculated daily.

This under-18s account pays bonus interest every month you deposit at least $10 and make no withdrawals. There is no minimum monthly balance requirement and no monthly transaction fee, while interest is calculated daily.

Designed to help you save money for Christmas, this account has access restrictions to stop you dipping into your savings. It features a competitive variable rate and there are no minimum balance requirements.

If you want to securely invest your money in a term deposit, BDCU Alliance Bank offers term-deposit accounts with terms ranging from 1 to 24 months. With a minimum investment of $1,000, interest rates vary depending on your deposit amount and term chosen. You can also select to have interest paid on maturity, six-monthly or monthly.

If you’d like to apply for a savings account with BDCU Alliance Bank, you can do so in three ways:

BDCU Alliance Bank offers competitive savings and transaction accounts with a range of flexible features. However, remember to compare accounts at finder.com.au to find the right product for you.

Everything we know about the Tasmea Limited IPO, plus information on how to buy in.

Cash usage continues to decline, but what happens next?

SPONSORED: Not sure if your current business account is right for your needs? Use our checklist to find out.

These General Terms and Conditions ("General Terms") apply to the game of chance identified as the "Competition" in the schedule of particulars for the Competition that explicitly references the General Terms ("Competition Schedule").

Our experts compared 24 policies, 160+ features and got over 140 quotes to help you find the best pet insurance products of 2024.

Get points from Virgin while you binge on your favourite shows.

SPONSORED: Using a loan matchmaking service can be a great way to get a personal loan that suits your needs – and a better deal on it too!

Finder acknowledges that today ASIC has filed an appeal with the Full Federal Court in relation to proceedings against Finder Wallet regarding its Finder Earn product.

Save $1,800 by switching to a more affordable health fund.

Abuse and violence towards retail workers and service staff has reached disturbing new levels, according to new research by Finder.