Over half of banks and 20% of fintechs don’t feel ready to engage with millennials

Meanwhile, the digital native they're looking to engage with may not exist in the way they think.

According to a recent survey, 64% of traditional financial service providers don't feel well-prepared to engage with digital natives and 50% of fintech companies only feel reasonably well-prepared.

Those surveyed were delegates from the 2016 Fintech Summit held in Sydney in May and were members of traditional finance companies as well as fintech startups. Digital natives were defined as people under 30.

The survey found that only 30% of fintech companies felt very well-prepared to deal with digital natives, while 20% felt not very well-prepared at all. Those surveyed from traditional financial services, which included insurance and wealth management providers, came in at nearly half of fintech companies that felt very well-prepared, with 18%. The same percentage (18%) of traditional financial services representatives surveyed felt reasonably well-prepared to engage with digital natives.

The results may come as a surprise to those in the business of financial disruption. The elusive millennial is the target market for many fintech startups, and by extension, the banks that are trying to compete with them.

Millennials, classified as those born between 1982 and 2000, are known as digitally savvy and early adopters of tech. However, a recent analysis from Roy Morgan has found that the millennial generation is more complicated than that.

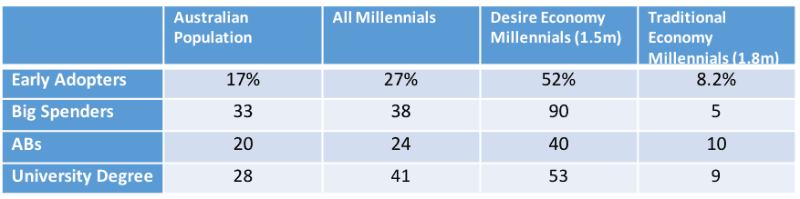

According to its research released in March 2016, there are 4.9 million millennials in Australia. However, you need to break this number down into two mindsets for it to be useful to people in fintech. Roy Morgan's database shows that 38% of millennials are "big spenders", as they're the top third of discretionary spenders in the economy. Another 24% are in the AB socio-economic quintile.

Using these numbers, it essentially breaks millennials down into two categories: the desire economy and the traditional economy. Fintechs are chasing the desire economy.

"The Desire Economy is the cool current in an overheated, overhyped ocean of product marketing, where basic needs are satisfied automatically and expeditiously. This is where 1.5 million millennials seek the path less travelled; signposted with authenticity, human scale, high-touch and digital disruption. This is where millennials look like, well, millennials," says Dr Ross Honeywill, executive director of the Centre for Social Economics.

When broken down into these two mindsets, the desirable traits that are attributed to millennials as a whole are more closely aligned to those in the desire economy, as this table demonstrates:

Source: Roy Morgan

Honeywill concludes that the millennial generation is good at telling us how old they are, but that's where the classification's usefulness ends.

There are multiple buzzwords in the land of fintech – disruption, unicorn, Internet of things, BaaS – and while they are all useful and have their place in the market, millennial is one that needs more clearly-defined boundaries.

There is also a market that fintechs and banks may be losing by focusing on digital natives purely because they fall in a certain age bracket. While the EY adoption index showed a high concentration of fintech adoption in the 25-34 age bracket (25.2% indicated they currently used two or more fintech products), 21.3% of 35-44-year-olds indicated this same. This percentage was higher than those in the 18-24-year-old bracket, of which only 17.7% owned two or more fintech products.

Image: Shutterstock