Cost of grocery staples skyrocket up to 31%: here are the most expensive items

Grocery bills are a major source of stress for 2 in 5 Australians.

Our experts compared 258 mobile phone plans from 48 providers – here are the best for 2024.

- Angus Kidman, money expert

Grocery bills are a major source of stress for 2 in 5 Australians.

Earn more from your money while rates are high.

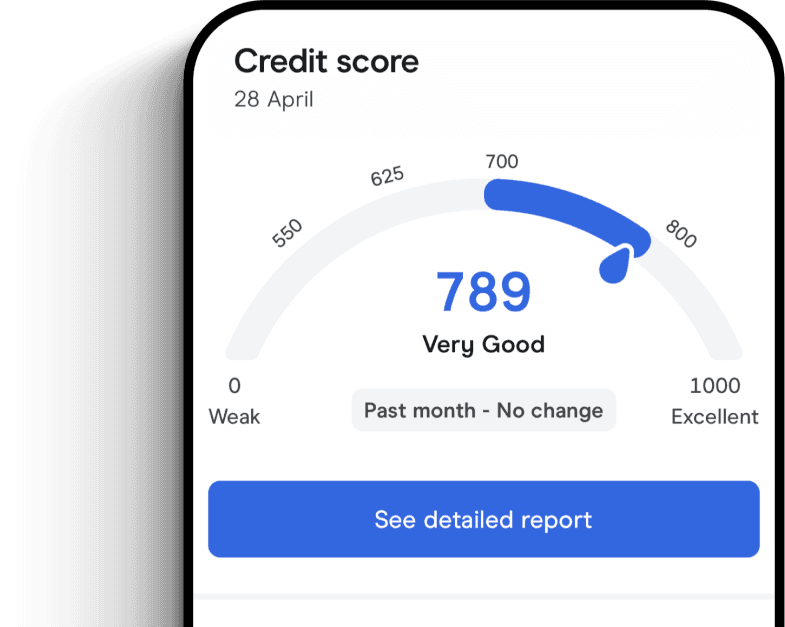

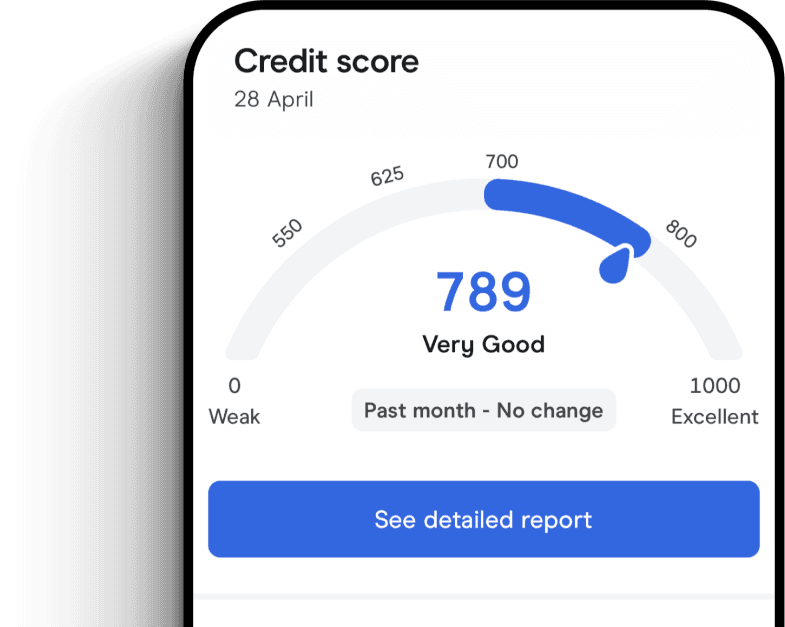

Our experts analysed 4,370+ data points to pick the winners.

We looked at 200+ loans to find our top picks.

We reviewed 250+ cards to pick the best by category.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies