Key takeaways

- Appendicitis surgery is generally free in Australia through the public health sector.

- If you’re being treated in a private hospital, the Medicare Benefits Schedule for an appendicectomy is $519.65.

- Bronze level and basic private health insurance policies cover appendix removal.

Why does appendicitis occur?

Appendicitis refers to the inflammation of the appendix. It typically begins when a blockage appears in the lining of the appendix, called the lumen. This blockage can lead to an infection where the bacteria multiplies and causes the appendix to become inflamed or swollen. If left untreated, the appendix may burst.

Appendix removal: what are my treatment options?

Medicare can fully cover appendix surgery as long as you receive treatment in a hospital. If you want to choose your own doctor, hospital and potentially get treated quicker, you might be better with health insurance. Appendix treatment is available with most policies for as little as $83 per month.

Appendicitis surgery cost in Australia

If you're treated as a public patient in a public hospital, appendicitis surgery is generally free in Australia.

However, you'll have some out of pocket expenses if you get treated in a private hospital and don't have health insurance. For example, the fee listed on the Medicare Benefits Schedule for an appendicectomy is $463.50. As Medicare covers 75% or $347.65 of the scheduled fee, you'll need to pay the remaining 25% of the fee yourself — that's $115.85.

It's extremely unlikely to be that cheap though as doctors often charge much more than the MBS fee. You will also need to consider anaesthetist, assistant and diagnostic fees.

Compare health insurance for appendix removal

You'll find health insurance for appendix removal in all bronze level health insurance policies, but a handful of basic policies can cover you as well. We've listed them below alongside costs. Keep in mind that you'll have a 2 month waiting period for new conditions or 12 months for pre-existing ailments. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

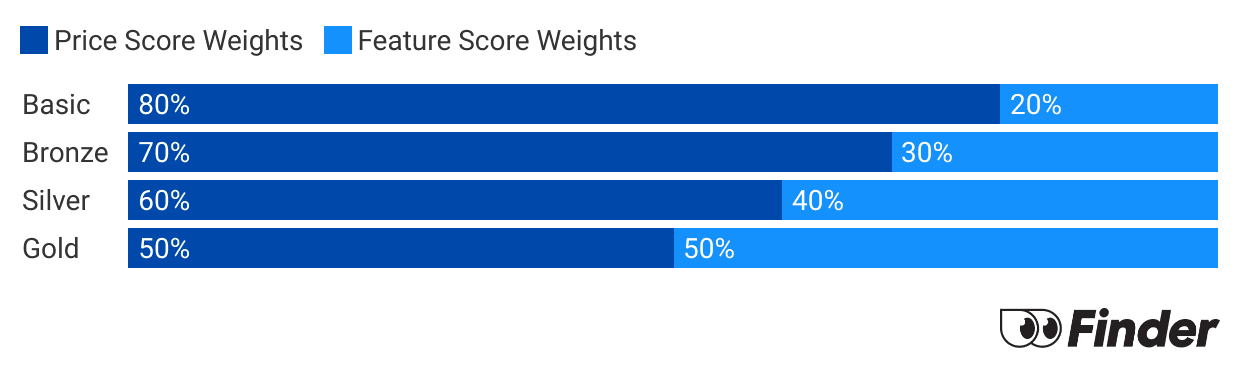

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Does Medicare cover appendix surgery?

Yes. If you're treated as a public patient in a public hospital, Medicare can cover 100% of appendix surgery expenses. Remember though, as a public patient, you generally won't be able to choose your own doctor or the day that you're admitted to hospital and receive surgery.

If you receive treatment as a public in a private hospital, the Medicare Benefits Schedule Fee (30720) for an appendicectomy is $463.50, of which Medicare covers 75%. However, doctors aren't obligated to stick to the MBS fee, so you might have to pay considerably more than the 25% if they do charge more.

How does health insurance cover appendix surgery?

You'll find appendix removal covered with all bronze tier health insurance policies under hernia and appendix. With private health insurance, you can choose your own doctor, hospital and in many cases, you'll get treated much quicker.

If you already have health insurance, chances are you've already served the waiting period as it's included in most policies.

The majority of insurers cover the cost of surgical and theatre fees, as well as for any medicine you receive whilst in hospital. It will also generally cover the cost of accommodation in a private hospital or bed.

There may be some out of pocket expenses if you don't have some form of gap cover. To have a good indication of any out of pocket expenses, you should find out the price of the following:

- Principal surgeon

- Anaesthetist

- Assistants

- Diagnostics for example x-rays, lab tests and medical imaging

How Finder partners cover appendix in detail

| Health fund | What services are covered? | Apply |

|---|---|---|

AHM AHM | AHM hospital cover policies cover the surgical removal of your appendix if you have appendicitis and need hospital treatment except for Starter Basic Hospital cover. This includes all agreed hospital charges in a partner private hospital in a shared or private room. In a public hospital, AHM will cover accommodation charges for a shared room and pay benefits towards the cost of a private room. A 12-month waiting period applies for pre-existing conditions, but this is shortened to two months in all other cases. | More info |

| If you require appendix removal, hospital cover from Australian Unity covers hospital accommodation costs, theatre fees, in-hospital pharmaceuticals and more . A two-month waiting period applies. | More info | |

| GMHBA Hospital Cover includes cover for theatre fees, doctor's fees and accommodation in a public or private hospital when you need to have your appendix removed except for Basic Plus (Restricted). Pharmaceuticals you receive as an inpatient are also covered. A two-month waiting period applies. | More info | |

| HCF Hospital Cover provides cover for the cost of an appendectomy, including hospital accommodation, theatre fees, surgical fees and pharmaceuticals. Whether or not you receive treatment in a private or public hospital varies depending on the level of cover you select. A two-month waiting period applies. | More info | |

HIF HIF | If you need to have your appendix surgically removed, cover is provided by HIF's suite of health insurance policies. This includes accommodation in a private hospital or as a private patient in a public hospital, plus theatre care, surgical fees and pharmaceuticals you receive in hospital. A two-month waiting period applies. | More info |

Transport Health Transport Health | All of Transport Health's hospital cover policies include cover for appendix removal. This includes hospital accommodation, emergency ambulance transport, theatre fees and pharmaceuticals. A two-month waiting period applies. | More info |

Frequently asked questions

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.