ANZ is killing off its MoneyManager site

The cross-bank financial management tool is being switched off at the end of July.

ANZ is discontinuing its MoneyManager site, an unusual financial management tool that analysed bank statements and spending patterns and could be used even if you weren't an ANZ customer.

In an email to current Money Manager customers, ANZ confirmed that it would be switching off the site from 31 July 2016.

"The way our customers are choosing to manage their personal finances online is changing, and as a result, we have seen a continuing decline in the use of the ANZ MoneyManager tool," the email said. "We realise this decision will be disappointing for a number of our customers and apologise for any inconvenience this change may cause."

The bank is encouraging current users to export data they have already stored at the site, and has provided detailed instructions on that process on its site.

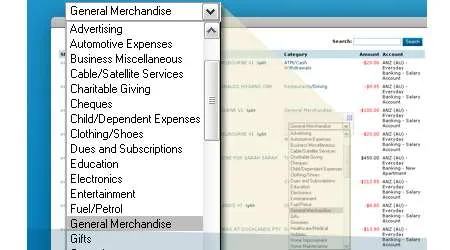

First introduced in 2008, MoneyManager automatically categorised expenses on bank accounts and helped users identify their spending patterns.

Though initially popular, it has faced increasing competition as money management apps designed specifically for mobile phones have gained prominence. ANZ itself was the first bank to roll out Apple Pay in Australia, and has seen an increase in customers as a result, so it's not surprising it is choosing to focus its technology efforts elsewhere.

While one recent survey suggested that just 15% of Australians currently use those kinds of apps, those users are likely to represent much of the core audience that used MoneyManager in the past.

The Yodlee technology which MoneyManager utilised continues to be employed by a number of other local banks and fintech startups.

Latest news headlines

- HECS-HELP hell: Your uni debt could jump by $900+ by July

- Ordinals and runes – the new crypto craze?

- Earn up to $1,297 by investing some of your savings | Dollar Saver tip #79

- Why are there millions of dodgy cars on Australian roads?

- Shady shoppers: Petty crime escalates as Australians hit hard by cost of living crisis