9 reasons why Australia is not heading for recession in 2020

Don't panic! Everything's fine.

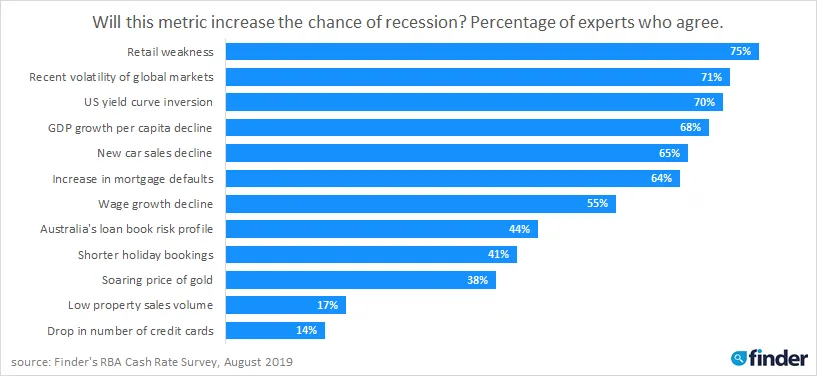

My recent insights blog painted a pretty gloomy picture for the Australian economy by rounding up twelve reasons why we may be likely to fall into a recession in 2020. Following the piece, I asked Finder's panel of market-leading economists whether they thought the metrics mentioned did actually increase the likelihood of recession.

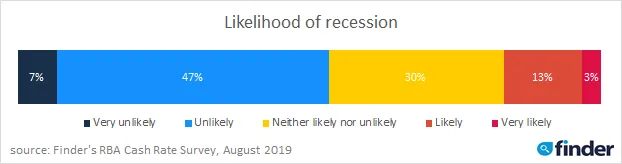

While economists tended to agree that most of the metrics cited made a recession more likely, it seems that our panellists were not convinced, overall, that Australia was heading for a recession. When asked directly whether a recession was likely in the next year, only 16% of panellists said this was either "likely" or "very likely" – a result that has remained relatively steady through our economist surveys over the last few months, despite the worsening economic environment.

So just why is it, despite all the doom and gloom, economists still think the economy will continue to grow? As to what my personal views are after compiling these two pieces, I'll get to that at the end. So, here are nine reasons why we won't experience a recession in Australia in 2020.

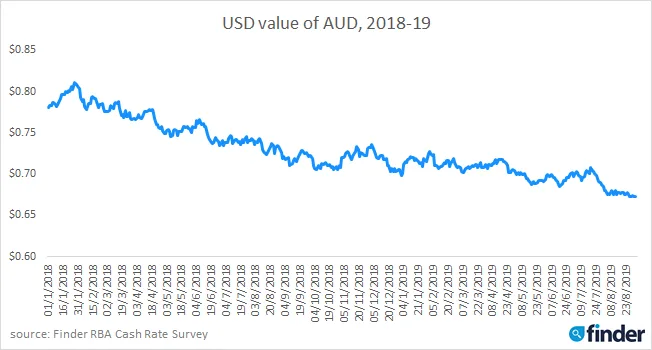

1. The low Australian dollar is a boon for many businesses

The Aussie dollar has fallen dramatically against the US dollar this year and should continue to slide. It has fallen from a high of 72 cents in February to 67 cents today, with the majority (59%) of economists surveyed in Finder's RBA Cash Rate Survey expecting its value to fall by a further cent or two by the end of the year. A falling Australian dollar is good for manufacturers as it makes Australian goods and services cheaper for international customers to buy and gives Aussie businesses an edge against their competitors. This should, in turn, help create more jobs.

The low dollar is also good for tourism businesses (more about this later), as it means tourists have more money in their pockets when they arrive and are able to spend more on things like meals out, extra excursions or better accommodation. Additionally, Australia's ability to control its currency gives it an advantage that many European countries such as Ireland, Portugal, Greece, and Spain didn't have during the global financial crisis due to their membership in the Eurozone.

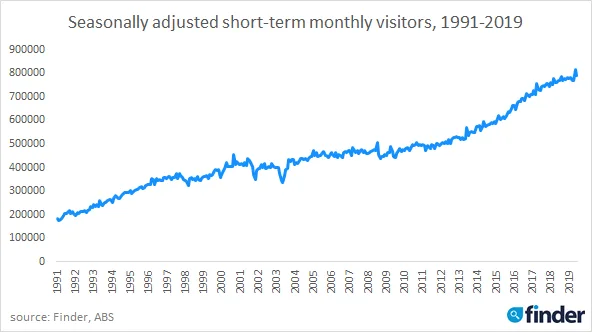

2. Tourists keep coming

Australia's sun, sea and sand continue to attract visitors. The number of tourists coming to Australia has been increasing steadily since the 90s, with nearly ten million short-term visitors arriving on Australian shores (or more likely, airports) over the twelve months to June. That's almost 40% of the Australian population arriving every twelve months for a holiday. With the tourism industry making up around 3% of GDP, this is a very important job creator in Australia.

3. Our population continues to grow at a higher rate than most other countries

As we have seen, Australia has always been an attractive destination for tourists, including backpackers on working holiday visas, some of whom choose to stay. Australia also attracts thousands of migrant workers who are hired from overseas to fill skill shortages here and tens of thousands of international students. Net overseas migration alone is responsible for over 60% of all population growth in Australia.

Australia's population is currently growing at around 1.6% per year. This is higher than the US (0.71%), the UK (0.65%) and many European countries. A steadily growing population generally fuels an economy by increasing the number of consumers in the market as well as demand for jobs. As long as the sun keeps shining, Australia can likely rely on this population growth to remain steady.

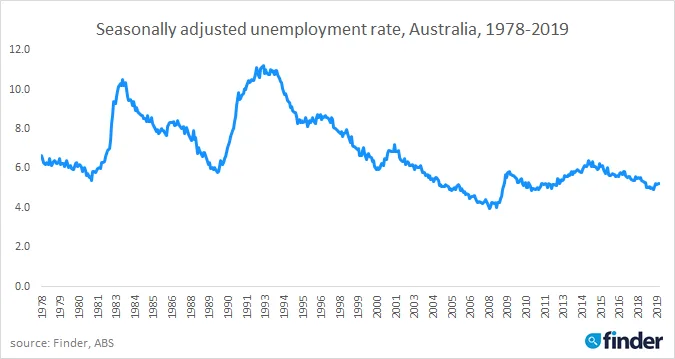

4. Unemployment remains low

Considering the above, it's reassuring to note that the Australian unemployment rate currently sits at 5.2%. This is right in the middle of the 4-6% bracket most economists consider to be healthy. While this is not as low as the US (3.7%), the UK (3.8%) or Germany (3%), it's far below Greece (17.4%), Spain (13.9%), Italy (9.9%), France (8.6%) and the EU average (6.3%). What this means is that the Australian economy is creating sufficient jobs to keep the unemployment rate low, despite our relatively high population growth.

5. Australian tech is booming

You won't go far in modern workplaces (including Finder) without using a product made by Atlassian – an Aussie tech firm that has become a very big deal. The company floated on the US stock exchange in 2015, making both of its founders instant billionaires. With a current market cap (total value) of $18 billion, Atlassian is Australia's biggest tech export, and it is not alone. Both Computershare and the REA group are worth around $10 billion, with several other companies rallying behind them.

While the ASX is still dominated by traditional enterprises, Australian tech firms such as Cochlear, OFX, Freelancer, Afterpay, Carsales, Culture Amp, Appen and Finder have been expanding into international markets such as the US and UK – with profits made overseas fuelling further research, development and jobs in Australia.

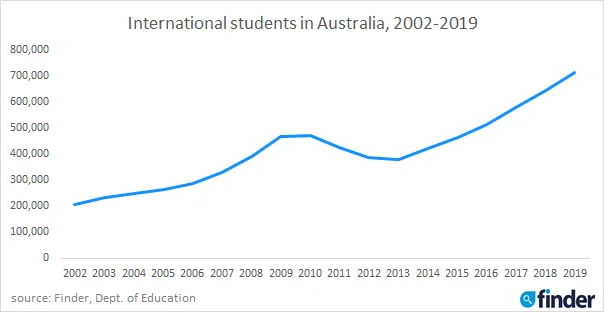

6. Overseas student numbers keep increasing

Australian universities are becoming increasingly popular internationally, with the number of foreign students increasing steadily since 2002. While the number of places offered to overseas students has caused some controversy recently, the higher fees paid by these students means there is more cash available to maintain Australian university infrastructure and fund jobs in education.

7. The government is investing heavily in infrastructure

The federal government has committed to investing $100 billion in infrastructure projects over the next ten years. This will fund multiple projects including WestConnex in Sydney, a long-overdue airport rail link in Melbourne, an upgrade to the Sydney-Brisbane Pacific Highway and the Melbourne to Brisbane inland rail, and an expansion of the passenger rail network in Perth. All of these projects will create jobs, with three experts (Shane Oliver of AMP Capital, Malcolm Wood of Baillieu Holst and Stephen Koukoulas of Market Economics) from our RBA panel citing infrastructure spending as one indicator that we're less likely to experience a recession in 2020.

8. The housing market recovery looks real

While the volume of stock on the Australian property market remains relatively low, prices keep creeping up. The average sale price increased by 0.8% nationally in August, with the highest increases recorded in Sydney (1.6%) and Melbourne (1.4%). These are very significant increases. Indeed, as recently reported by Elizabeth Knight in the Sydney Morning Herald, twelve months of similar results would mean a full reversal of all price declines seen in the eastern capitals over the last two years. Add last week's 82% Sydney auction clearance rate into the mix and the recovery looks well underway.

However, the recovery remains uneven. Prices have fallen in Adelaide, Darwin and Perth. While the charts are definitely heading in the right direction, we can't fully rule out the possibility of this being a dead cat bounce.

| City | CoreLogic price change, month on month, August 2019 | CoreLogic price change, quarter on quarter, August 2019 |

|---|---|---|

| Sydney | 1.60% | 1.90% |

| Melbourne | 1.40% | 1.80% |

| Brisbane | 0.20% | -0.10% |

| Adelaide | -0.20% | -1.00% |

| Perth | -0.50% | -1.80% |

| Hobart | 0.50% | 1.00% |

| Darwin | -1.20% | -0.14% |

| Canberra | 0.80% | -0.40% |

| National | 0.80% | 0.60% |

9. Australia has dodged the recession bullet several times before

Proving that we may well be The Lucky Country, Australia has managed to avoid being dragged into a surrounding recession on at least three occasions in living memory – the most significant of which was following the global financial crisis of 2007. Indeed, as former Prime Minister Kevin Rudd pointed out in his 2018 article for the Financial Review, Australia successfully navigated the GFC without losing a single financial institution or its AAA credit rating.

When Treasury Secretary Ken Henry advised Rudd to "Go hard, go early, go households" to avoid recession, the government arranged two separate deposit guarantees and a fiscal stimulus package including investment in schools, infrastructure and a more generous home buyer's grant. "We avoided going into recession in 2009, albeit by the skin of our teeth," said Rudd, "and Australia, as a result, has now completed 27 years of continuous economic growth." Let's hope that continues.

Conclusions

I was expecting that writing this no-recession piece to be more of a challenge than writing the recession piece a couple of weeks ago – and it was, to a degree. But now that all the straws have been grasped, together they make a relatively convincing argument that Australia's long run of good luck may continue. On balance, I'm still cautious. Recent reports have shown that if you remove government spending from the economy, Australia's GDP would have shrunk in the June quarter. While this is sobering, it must be noted that it was partially spending on infrastructure that helped us dodge the last recession.

I feel I should put my money where my mouth is here. I'm in the market to purchase a property in Sydney and have decided to hold off for now. Not only are the current sales figures insufficient to confirm whether we're on the right side of recovery, economists in our survey ranked both Melbourne and Brisbane above Sydney when asked where they would invest $500,000. Additionally, only 45% of respondents said they expect property prices to continue to rise nationally. Market forces are governed, in the end, by psychology - and the public seem to be convinced that we're heading for recession. We survey 1,000 Australian in a nationally representative consumer survey every month - and the number of respondents who think a recession is likely has been increasing stedily from 70% in May to 82% in September. For these reasons, I'm holding off, but I may live to regret that decision.

So, have we emerged from the long, dark night? Time will tell. In the meantime, keep an eye on this blog or follow me on twitter for more discussion and updates as these metrics change.

Graham Cooke's Insights Blog examines issues affecting the Australian consumer. It appears regularly on finder.com.au. For regular updates check out twitter @gcooke42.

Picture: Getty/Shutterstock